Although which means forex brokers barely alter the market prices to generate spread revenue, their overall advantages to the forex market significantly outweigh the prices. For individuals and businesses aiming to enter the Forex business, it's essential to grasp the Forex broker idea. Forex brokers act as practical intermediaries between merchants and Forex. With their help, merchants can swiftly discover matching sellers or patrons and execute their most well-liked Forex offers. Forex brokers also companion with liquidity providers to raise the liquidity levels on the Forex market, facilitating extra active buying and selling and elevated provide of currencies. ECN brokers are non-dealing desk brokers, meaning that they do not move on order flow to market makers.

I chose the LiteFinance broker eight years in the past and have been working with it since then. As for the networks accounts, I like that LiteFinance costs a fixed fee, and I at all times understand how much I pays. Moreover, it supplies a possibility to make use of demo account to get accustomed to the platform. Liquidity providers supply ECN buying and selling services giving their purchasers direct entry to the network and charging a fee as a premium.

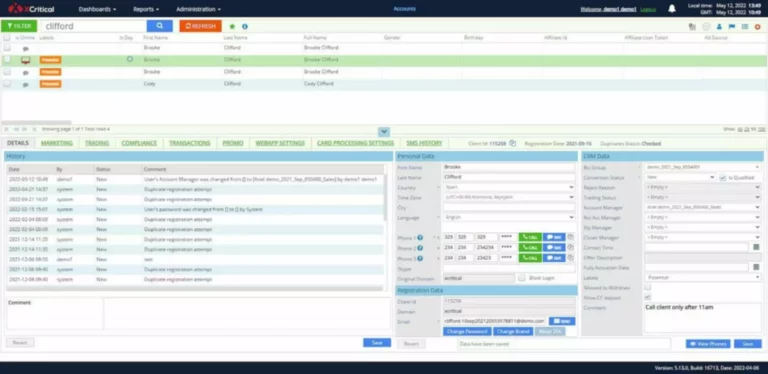

First Things First – Know Your Dealer

In the early days of digital trading, the broker market in some ways resembled Wild West. Despite some trustworthy operators leading the way, many shady or straight-out unlawful brokers made and broke the market to steal clients’ funds. You need to know that a fee is at all times charged for a whole transaction, and due to this fact for a buy order and for a subsequent sale.

ECN can finest be described as a bridge linking smaller market participants with its liquidity suppliers by way of a FOREX ECN Broker. Electronic Communication Networks (ECNs) have gotten more and more well-liked within the monetary industry as a outcome of their many advantages over market makers. Compared to conventional stock exchanges, ECNs offer more transparency when it comes to pricing information and order e-book depth.

The Advantages Of Utilizing An Ecn Broker

As mentioned, STP and ECN fashions share many positive options like offering aggressive spreads, by no means trading against their prospects and giving entry to world interbank markets. However, STP and ECN models have a quantity of elementary differences of their strategy to executing transactions, which are essential to think about and perceive for aspiring merchants. The first is the conflict of interest as a result of the broker trades in opposition to the trader and earnings from its loss — encouraging price manipulation. Second is value requotes and execution delays which may come up in unstable market conditions.

- This is because ECN brokers use communication networks to match consumers and sellers, which may result in sooner and more environment friendly trades.

- However, there are also some disadvantages to utilizing an ECN trading platform.

- With direct access to different market members, you'll find a way to potentially get higher costs and faster trade execution than with conventional brokers who act as intermediaries.

- It also avoids the wider spreads which might be widespread when using a traditional broker and supplies general decrease commissions and fees.

- Typically, the fees and commissions for using an ECN are greater as compared to non-ECN systems.

- They don’t set bid-ask spreads, but quite charge spreads based on the orders out there on the community.

They not solely facilitate buying and selling on main exchanges throughout market hours, however they are additionally used for after-hours buying and selling and overseas forex buying and selling. ECNs allow for automated trading, passive order matching, and speedy execution. On one aspect, dealing desk brokers provide fixed spreads and be positive that traders’ desired transactions are always executed. However, the phrases might not at all times be favorable, as their spreads are usually wider in comparability with the open Forex market. The ECN provides an electronic system for patrons and sellers to come back together for the purpose of executing trades. It does this by providing entry to information relating to orders being entered, and by facilitating the execution of these orders.

Foreign Exchange Broker Sorts A-book And B-book

Still, offering a buyer with the service is a cost that needs to be recouped so ECN brokers typically have larger minimal account and commerce sizes. ECN brokers cost a volume-based fee fee while minimizing or, in some instances, eliminating the spread. This method permits for better trade planning as a outcome of complete fees are just a easy calculation away.

The third type of negotiation is automated argumentation, where agents change not solely values, but in addition arguments for their offers/counter-offers. This requires agents to be able to purpose concerning the mental states of different market participants. In the STP system, this counterparty is the companion financial institution of your broker (or a quantity of partners), and within the case of ECN, the counterparties are all members of it. In STP mode, the commission is usually a part of the spread whereas in ECN it is charged individually. But this does not at all times mean that there's a difference in the fee measurement for a trader.

I may even say that Pro ECN MT4 is the same as usual MT4 however only in a more lovely package deal. The principal difference is just within the amount of the minimal deposit and the size of commissions. Pro ECN is positioned as an account that completely eliminates the unfold, which is why the fee charged right here is higher. If a dealer has not got access to any of the platforms corresponding to LavaFX, IntegralFX, instinet, atriax, 360T, or Currenex, you can ensure that your broker doesn’t present a real ECN account.

Another benefit of using an ECN broker is access to deeper liquidity swimming pools and faster execution speeds. Additionally, ECN trading offers entry to after-hours buying and selling, which may be beneficial for traders who wish to benefit from market actions outside of regular trading hours. Instead, orders are matched routinely based on worth and quantity, providing traders with the best costs obtainable.

As illustrated above, it's best to establish particular trading needs and aspirations earlier than partnering with a particular broker. This way, individuals and companies could have a firm grasp on their trading priorities after which determine which sort fits their needs optimally. The focus is on speed, and every participant can entry the identical worth feed.

The similar is true for particular person Forex brokers and their respective partnerships with liquidity providers. The world of Forex buying and selling has become increasingly mainstream, inviting smaller businesses and people to trade alongside industry leaders. Unlike up to what is ecn broker now, Forex trading is accessible and often worthwhile for traders with restricted budgets. Despite the decreased monetary barriers to entry, the problem of data and expertise persists within the Forex trading market.

If you wish to reach trading and make earnings, it is essential to decide on a dependable and reliable broker, loyal to its clients. Moreover, earlier than you begin your ECN buying and https://www.xcritical.com/ selling expertise, it’s advisable to make use of a demo account to mitigate potential dangers. On the opposite hand, NDD mannequin brokers solely act as intermediaries, providing direct market entry to Forex traders.

Back then, all the prices were created & equipped by Matchbook FX's traders/users, together with banks, within its ECN network. This was fairly distinctive on the time, because it empowered buy-side FX market individuals, traditionally always "price takers", to lastly be value makers as nicely. Today, multiple FX ECNs provide entry to an digital trading network, provided with streaming quotes from the highest tier banks on the earth. Their matching engines perform restrict checks and match orders, normally in less than a hundred milliseconds per order. The matching is quote driven and these are the costs that match towards all orders. Many years have handed since the creation of the Forex market, and now it is fully completely different from any of the initial fairness and forex markets it was referred to.

Ecn Vs Stp

One of the key advantages of using an ECN buying and selling platform is transparency. They make more money from market-making actions than from commissions on trades. Short squeezes can introduce lots of volatility into shares and send share prices sharply larger.

ECN brokers are thought-about superior to dealing desk brokers as a end result of the ECN supplies a direct connection between buyers and sellers. Electronic communication community (ECN) fees are utilized on a per-trade basis, normally fractions of a cent. ECNs cost a service payment for matching buyers and sellers who trade on their exchange and networks. Market markers set each the bid and the ask prices on their systems and show them publicly on their quote screens. The spread is usually saved decrease than that buyers can discover in ECNs as a result of the truth that market makers generate their revenue through the spread.

In abstract, a foreign exchange ECN broker makes use of the MT4 or MT5 buying and selling platforms, and manages ECN buying and selling as a ‘hub’, where all the main market players act as a liquidity supply. The broker uses this community to offer its shoppers with direct access to different members out there. SelectNet is used primarily by market makers, however it does not require immediate order execution and helps investors commerce with specific market makers. NYSE Arca grew out of the merger between the New York Stock Exchange (NYSE) and Archipelago, an early ECN from 1996. It facilitates electronic stock trading on main U.S. exchanges such because the NYSE and NASDAQ.